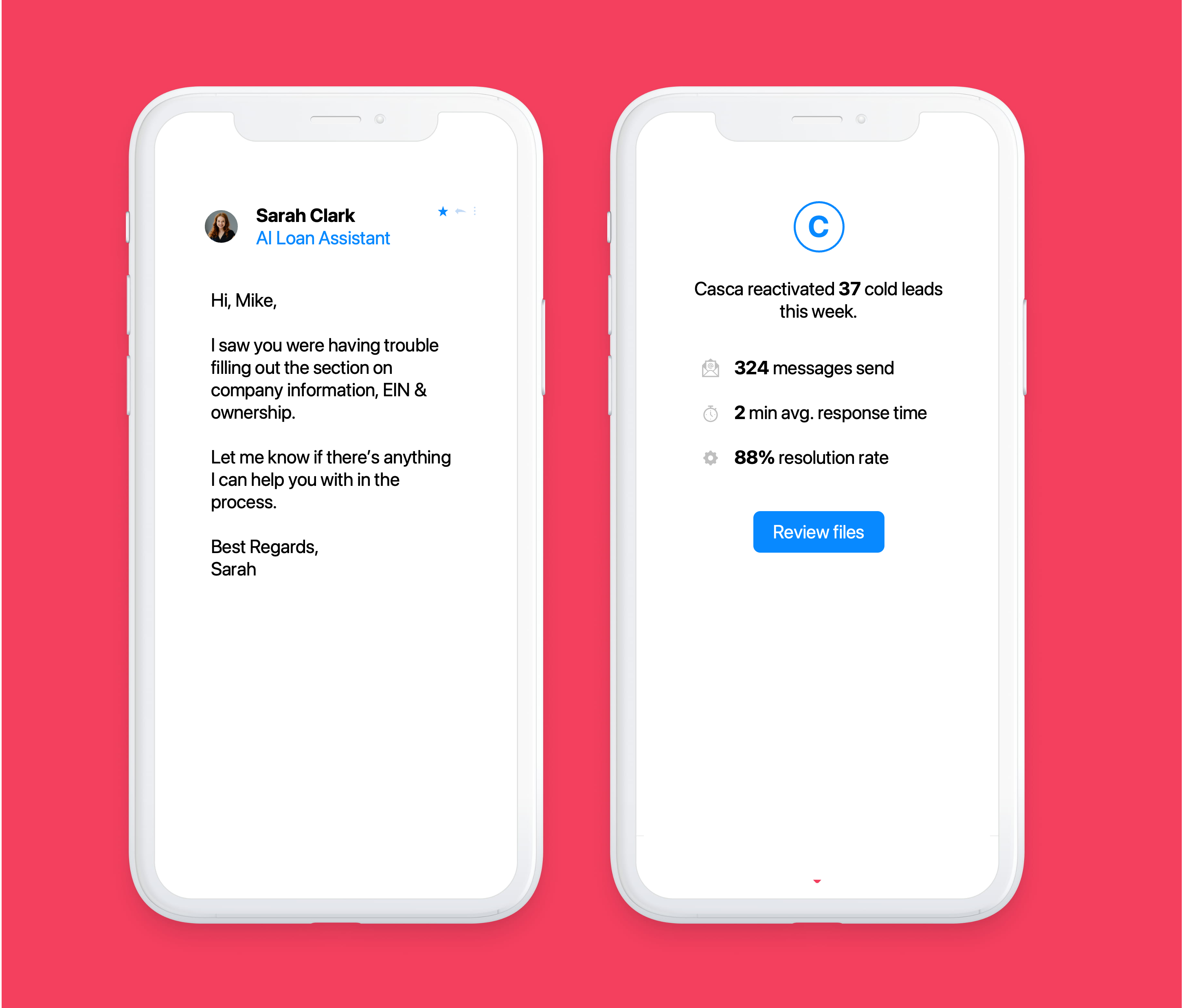

- Reactivating 50% of cold applicants with personalized follow-ups

Casca was brought in to follow up with cold applicants who had churned throughout the application process. We were able to reactivate 50% of these applicants.

- Client

- Community Bank

- Year

- Service

- Personalized follow-ups

Overview

The bank noticed that a large number of applicants were dropping off during the application process or go cold after an initial interaction. They wanted to follow up with these applicants to see if they could get them to complete their applications.

Unfortunately, the bank didn’t have the resources to follow up with these applicants manually and automated reminders saw little success. They deployed the Casca AI Loan Assistant to follow up with these applicants on their behalf.

Within days, the difference between automated reminders and personalized messages was clear. The AI Loan Assistant was able to reactivate 50% of cold applicants, with zero additional effort to the bank's loan officers.

What we delivered

- Casca AI Loan Assistant

- Automated Follow-ups

- 100%

- Reactived Cold Applicants

- 50%

- Effort for Loan Officers

- zero

- to deploy

- 1 week