- Tripling lead conversion rates for SBA 7(a) loan applications

Casca was brought in to help an FDIC-insured bank modernize their digital SBA 7(a) loan application process. We were able to triple lead conversion rates.

- Client

- FDIC-insured Bank

- Year

- Service

- SBA 7(a) Loan Applications

Overview

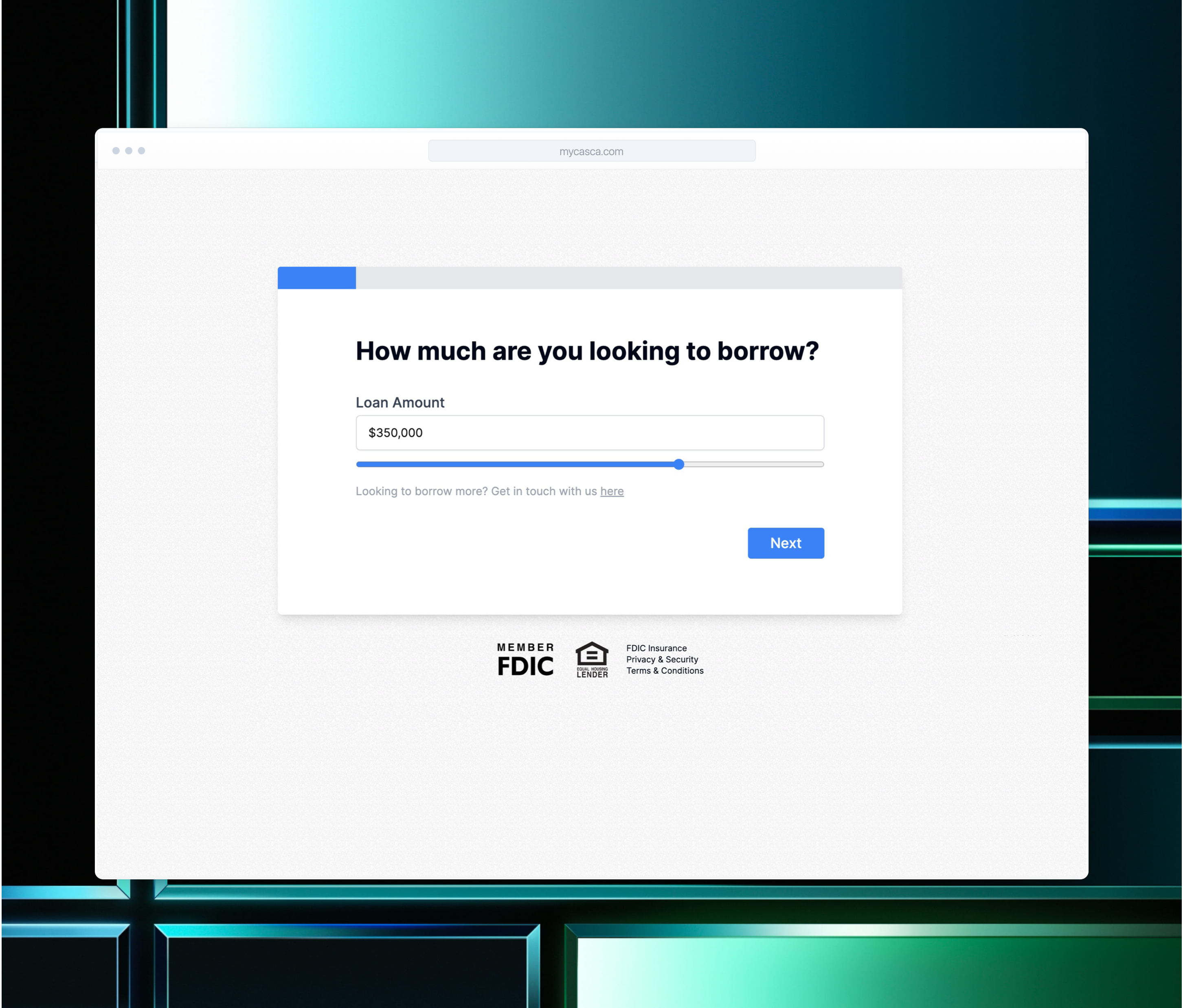

Over the course of two weeks, we replaced an outdated online application process with a modern, intuitive, and mobile-friendly experience integrated with the Casca AI Loan Assistant.

The legacy loan application took users up to 2 hours to complete, requiring heavy assistance from loan officers, leading to two major problems:

- high churn rates (users abandoning the application)

- high customer acquisition costs (loan officers spending too much time on each application)

After deploying Casca, the bank saw a 3x increase in lead conversion rates, with a 90% reduction in loan officer time spent on each application:

- higher conversion rates (users completing the application often in less than 7 minutes)

- lower customer acquisition costs (loan officers spending less than 5 minutes on each application before underwriting)

In addition, the bank noticed that more than 50% of applications came in outside of working hours: The Casca AI Loan Assistant was able to respond to these applications in 2-3 minutes, compared to previous average response times of 12-24 hours.

What we delivered

- Online Application Form

- Casca AI Loan Assistant

- Higher conversion rates

- 3x

- Time saving for loan officers

- 90%

- Average Response time

- 2-3 min

- to deploy

- 2 weeks